By Swati Lodh Kundu

BANGALORE - After success in business process outsourcing (BPO), India has begun to taste the fruits of knowledge process outsourcing (KPO). At present, the US alone accounts for 60% of the KPO work outsourced to low-cost locations like India, while UK and Canada account for 20%, the rest coming from Europe.

India has favorable government regulations that support R&D (research and development). The country is also adopting the intellectual property regime formulated by the World Trade Organization (WTO). The government offers financial incentives for R&D as well. Customs duties on clinical trial have been waived. Also, good clinical practice (GCP) guidelines have been made mandatory.

R&D investment in the country has seen 45% growth during 2002-04, at about US$6.8 billion, positioning India as the third most favorable destination for R&D investment, according to a recent study. In addition to 85% of the R&D carried out by the government through its research labs and PSUs (public sector units), several multinationals have set up R&D centers in India. The Council of Scientific & Industrial Research (CSIR), with 38 labs and 80 polytechnology transfer centers, has the largest R&D network in India. Apart from it, there are about 2,000 recognized R&D institutes. Every year 6,000 PhDs come out from the 380 universities in India. The country also has 2.5 million graduates. All these factors make it a favorable cost-effective location for research and development.

According to a report by Evalueserve, the Indian KPO market will grow about 49% by 2010. On the other hand, the BPO sector is slated to grow 30.6%. For clients, outsourcing knowledge-based work leads to significant cost savings. While an American MBA graduate earns $85,000 a year as a starting salary, his Indian counterpart earns only $12,000 - a cost savings of 85%. A PhD in the US earns $80,000 annually, while his Indian equivalent earns around $16,000.

Due to a 12-hour time difference between the US and India, a KPO vendor can provide a 24-hour work-cycle to the US client. According to the survey, 30% of the revenue of a typical KPO vendor is retained in the form of profits, while 35% goes to employee costs. The remaining 35% goes to overhead costs like transportation, food, telecom, security, etc.

KPO vs BPO

KPO involves high-end processes like valuation research, investment research, patent filing, legal and insurance claims processing, online teaching and media content supply. In BPOs, there is a pre-defined way to solve a problem and employees are trained to learn that method. BPOs will normally include transaction processing, setting up a bank account, selling an insurance policy, technical support, voice and email-based support. In case of KPO, however, there is no pre-defined process. One can look at it as transformation of unsorted data into useful information.

India, with its firepower of chartered accountants, doctors, MBAs, lawyers and research analysts is well positioned to grab a big slice of the global KPO business. Those battling with India in this arena will be Russia, China, the Czech Republic, Ireland and Israel. China is likely to get a bigger share of the Japanese and Korean markets due to cultural similarities. Russia, with its third-largest army of engineers and doctors in the world, will make a bid to capture the European KPO market. Close proximity and cultural compatibility will boost its position as an attractive nearshoring country for European businesses. But Cold War inertia and isolation from the US in the past will hamper its overall growth as a viable KPO base. It will also face competition from Ireland and the Czech Republic in the European market.

India, with its knowledge base and lower costs, will be leading the pack in the race for KPO businesses. According to the Evalueserve report, India will capture more than 70% (approximately $12 billion) of the KPO territory by 2010. The most sought after will be professionals well versed in data search and management. Biotech and pharma graduates will be in demand. While data search will constitute 29%, pharma and R&D will form 18% of the $17-billion global KPO pie. Other hot areas will be animation, publishing, remote education, VLSI (Very Large Scale Integrated) chip and engineering design.

With more and more KPO business coming into India, BPOs will try to upgrade themselves into KPO units as revenue per unit is more in the latter than former. And the first to benefit will be those already working in a BPO, with some degree of specialization. According to Evalueserve estimates, "Drafting and filing of a patent application costs anywhere between $10,000 and $15,000 [in the West]. Offshoring even a small portion of the process to an agent in India can save up to 50% for the end-client." India is already a hub for those willing to outsource their R&D operations, be it chip design or pharma and biotech research. In fact, quite a few companies are locating their R&D divisions in India. Some US law firms have set up their captive centers in India. Others are collaborating with Indian firms for the same.

Also, being high up in the value chain, KPOs offer considerably higher incentives to rope in talent. The Evalueserve report reveals that whereas an Indian BPO executive earns about $6,000 a year, his KPO cousin is sure to make anywhere above $8,800 - a huge 46% difference. The salary gap is not limited to BPO versus KPO. Whereas a fresh medical graduate or lawyer earns Rs150,000 (US$3,400) annually, a job with KPO offers at least 500% more. Fresh doctors and lawyers take home a cool Rs600,000-800,000 salary package at KPOs. Compare this with the pay packets of MBAs from non-IIM (Indian Institute of Management) institutes, who take home Rs300,000-500,000 per annum, or the yearly package for fresh IIM grads, at Rs400,000-600,000. Economists and statisticians are also in great demand for data modeling and analysis.

In contrast to BPOs, KPOs require understanding of how a client works. But the contracts in the KPO industry will be of much shorter duration. They may range anywhere from three weeks to six months. So delivering high-quality work will be a major challenge. Several Indian BPOs have recognized this opportunity and are in the process of developing KPO capability.

Over the last couple of years, small Indian KPOs have emerged and are doing well. However, it's MNCs like GE and Evalueserve, with their huge resources, which have been doing better. GE has been hugely successful with its 2,000-strong workforce at its research center in Bangalore. Efunds has more than 80% of its workforce in India. The figure for Evalueserve is even more astonishing - Out of 650 employees globally, 600 are based in India.

Clearly, in the future, it's KPO rather than BPO that will put India in the cutting edge of outsourcing business. Moreover, with countries like Ukraine, Hungary, Belgium, the Czech Republic and the Philippines offering BPO services at a lower rate, India will have to tilt toward KPO more heavily at some point. India, it is estimated, will have more than 250,000 KPO professionals by 2010. At present, the figure stands at a mere 25,000.

However, KPO will not crowd out the BPO business altogether. Revenues in absolute terms will always be higher from BPOs. While KPO exports from India are projected at $12 billion by 2010, BPO exports will be much higher at $20 billion for the same year. But India may start to lose its low-cost advantage in the future, as low-end services may move to cheaper destinations like Ukraine, Belarus and Malaysia. Developing its KPO industry is thus an absolute necessity for India to stay ahead in the global outsourcing game.

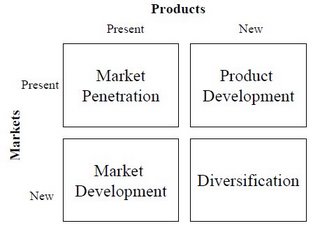

The Ansoff Product-Growth Matrix is a marketing tool created by Igor Ansoff in order to portray alternative corporate growth strategies, focusing on the firm's present and potential products and markets (customers). By considering ways to grow via existing products and new products, and in existing markets and new markets, there are four possible product-market combinations.

The Ansoff Product-Growth Matrix is a marketing tool created by Igor Ansoff in order to portray alternative corporate growth strategies, focusing on the firm's present and potential products and markets (customers). By considering ways to grow via existing products and new products, and in existing markets and new markets, there are four possible product-market combinations.